Options

Trading Strategies

Bear

Call Spread

Bear Call Spread option

trading strategy is used by a trader who is bearish in nature and expects the underlying

asset to dip in the near future. This strategy includes buying of an ‘Out of

the Money’ Call Option and selling one ‘In the Money’ Call Option of the same

underlying asset and the same expiration date.

Related Articles

👆How to calculate option price (Options Pricing)

👆Options Trading Strategies India

👆Options Trading Strategies Long Call

👆Options Trading Strategies Long Put

👆Options Trading Strategies Short Call

👆Options Trading Strategies Short Put

👆Options Trading Strategies Collar

👆Options Trading Strategies Bull Call Spread

👆Options Trading Strategies Bull Put Spread

When you write a call, you

receive premium thereby reducing the cost for buying of OTM Call Option. This

strategy is also called as ‘Bear Call

Credit Spread’ as your account gets credited at the time of entering the

positions.

A bear

call spread consists of one short call with a lower strike price and one long

call with a higher strike price. Both calls have the same underlying stock and

the same expiration date.

The Bear Call Spread is a

two leg spread strategy traditionally involving ITM and OTM Call options.

However you can create the spread using other strikes as well. Do remember, the

higher the difference between the two selected strikes (spread), larger is the

profit potential.

The bear

call spread is an options strategy that works by letting the options decay

slowly day after day until the expiration date, resulting in both options

expiring worthless and the investor and keeping the entire premium.

The most

an investor can expect to make on this trade is the credit or premium they

received. If the stock finishes below the lower strike price at expiration, the

investor will achieve maximum profit.

This is a

great strategy to use if the investor feels a stock is moving sideways lower,

but not sure on their timing or wants to giving themselves a cushion in case

the market moves sideways or trades up slightly.

Breakeven: Break-even

at expiration is short call strike + net premium received.

Risk: Limited

Reward: Limited, maximum potential profit is limited to the net credit

(premium) received.

Action

Sell

1 ‘In the Money’ Call Option

Buy

1 ‘Out of the Money’ Call Option

Bear Call

Spread

Example

Suppose that the NIFTY is

trading around 11400 level, and Mr. G enters into Bear-Call-Spread strategy.

The Lot Size of NIFTY is 75.

He sells one 11300 ITM Call

Option for Rs. 200 and buys one 11600 OTM Call Option for a premium of Rs. 40.

His account will be credited by Rs 12000. ((200-40)*75).

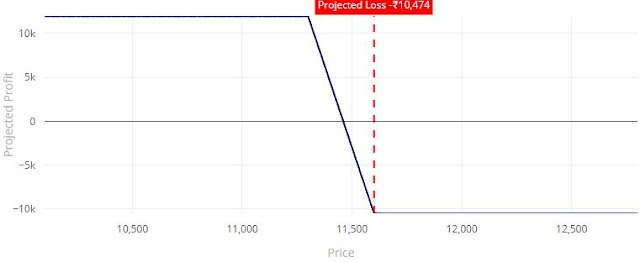

Here’s a look at the payout

diagram at expiration with results.

|

| Image by - sensibull.com |

Breakeven: Break-even

at expiration is 11460 (11300+200-40).

|

| Image by - sensibull.com |

Case 1: At expiry, if the NIFTY

closes at 11300 level, then Mr. G is allowed to keep the credit amount i.e. Rs.

11,966.

|

| Image by - sensibull.com |

Case 2: At expiry, if the NIFTY

closes at 11000 level, then the trader will make a profit of Rs. 12,000.

((200-40)*75)

|

| Image by - sensibull.com |

Case 3: At expiry, if the NIFTY closes at 11600 level, then the trader will make a loss Rs. 10,474.

No comments:

Post a Comment