|

| Image by - shutterstock.com |

Double

Entry System

Or

Double

Entry Book-keeping System

Meaning of

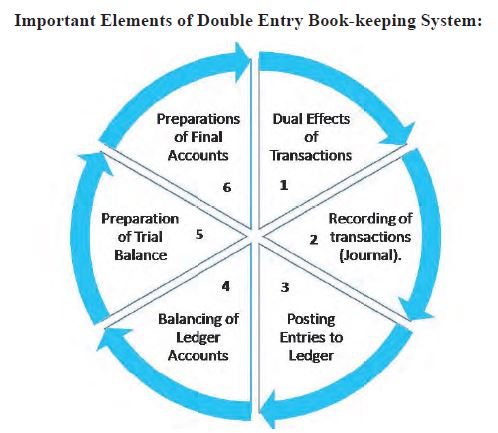

Double Entry System

Double Entry Book-keeping

System is the most scientific method of recording all monetary transactions in

the books of accounts. This system owes its origin to Italian Merchant “LUCA D.

BARGO PACIOLI” on 10th November 1494 and this day is celebrated as

International Accounting Day.

This system of Bookkeeping is

based on the fact that there are two aspects of every business transactions.

Every business transaction involves two persons or accounts or parties where in

one is the receiver of the benefit and the other is the giver of the benefit.

If something comes into the business, something goes out from the business.

Recording of two aspects of monetary transactions in the Books of Account in

terms of Debit (Dr.) and Credit (Cr.) is called as "Double Entry" System

of Book-keeping.

According to modern

approach, every business transaction is concerned with Assets, Liabilities, Capital,

Expenses and Income. Whenever there is an increase in assets and expenses it is

debited and decrease in assets and expenses are credited.

A bookkeeping financial

accounting ledger double-entry system is a set of rules for recording financial

information in a system in which every transaction or event changes at least

two different nominal accounts.

The name derives from the

fact that financial information used to be recorded using pen and ink in paper

books – hence "bookkeeping" (whereas now it is recorded mainly in

computer systems) and that these books were called journals and ledgers (hence

nominal ledger, etc.) – and that each transaction was entered twice (hence

"double-entry"), with one side of the transaction being called a debit

credit. And the other a credit.

Related Articles

👆 Financial Accounting

👆 Types of Accounting

👆 Cost Accounting

👆 Types of Cost Accounting

👆 Methods and Techniques of Costing

👆 Cost Sheet

👆 Cost Management

👆 Cost Control and Reduction

👆 Cost Accounting System

👆 Difference between Cost Accounting and Financial Accounting

👆 Management Accounting

👆 Materials Control

👆 Bookkeeping

👆 Accounting methods

👆 Accounting Terminologies

Accounting entries

In the double-entry

accounting system, each accounting entry records related pairs of financial transactions

for asset, liability, income, expense, or capital accounts. Recording of a

debit amount to one or more accounts and an equal credit amount to one or more

accounts results in total debits being equal to total credits for all accounts

in the general ledger.

If the accounting entries

are recorded without error, the aggregate balance of all accounts having

positive balances will be equal to the aggregate balance of all accounts having

negative balances.

Accounting entries that

debit and credit related accounts typically include the same date and

identifying code in both accounts, so that in case of error, each debit and

credit can be traced back to a journal and transaction source document, thus

preserving an audit trail. The rules for formulating accounting entries are

known as "Golden Rules of Accounting". The accounting entries are

recorded in the "Books of Accounts". Regardless of which accounts and

how many are impacted by a given transaction, the fundamental accounting equation

A = L + OE will hold, i.e. assets equals liabilities plus owner's equity.

Methods

of Recording accounting information

Indian System

Indian

system maintains, records in Indian languages, such as Marathi, Hindi, Urdu,

Gujrati etc. It is called Mahajani Deshinama system. In this system

transactions are recorded or maintained in long books, known as Bahi-Khata and

Kird. This system of accounting is not based on Double Entry system of

accounting. Thus, is not a scientific accounting system. Even today this system

is used in India for small business organization.

English

System

Single Entry System

This

system of accounting records only Cash book and Personal accounts. It is

unscientific method and also known as an incomplete recording system, because

it changes with the convenience of business for recording transactions. This

system of accounting does not provide accurate information about the financial

position of business and it is suitable for small business.

Double Entry System

Double Entry System is the most scientific method of recording all business transactions in the books of accounts. Under this system double or two fold effects of each transaction is recorded.

According to Double Entry

Book-keeping System, one account is to be debited and another account is to be

credited with equal amount.

Every debit has an equal

and corresponding credit of the same amount is the basic principle of Double

Entry System.

Definition

of Double Entry System

“Every business transaction

has a twofold effect and that it affects two accounts in opposite directions and

if a complete record is to be made of each such transaction it would be

necessary to debit one account and credit another account. It is this recording

of two fold effect of every transaction that has given rise to the term Double

Entry.” – J.R. Batliboi.

Principles

of Double Entry System

In every business

transaction there must be minimum two effects i.e debit and credit.

Two Accounts means one is

the Receiver of the benefit and other is the Giver of the benefit.

If one account is debited

other account must be credited.

Every debit has a equal and

corresponding credit of the same amount.

Advantages

of Double Entry System

Scientific system: This is the only

scientific system of recording business transactions. It helps to attain the

objectives of accounting.

Complete Record: Under this system all

business transactions are recorded. This method is scientific and records both

the aspects of each transaction.

Accuracy: In this system both aspects

are recorded in the books of accounts so it gives complete accuracy in

accounting work. It also checks arithmetical accuracy.

Business Results: All expenses, losses,

income, gains, liabilities, assets, debtors and creditors all these

transactions are recorded, therefore it helps to find out accurate business

results of particular accounting period.

Common Acceptance: It is widely accepted since

it follows universal accounting principles. Double Entry System is accepted by

financial institutions, government authorities etc.

Full details for control: This system permits

accounts to be kept in a very detailed form, and thereby provides sufficient information’s

for the purpose of control.

Comparative study: The results of one year

may be compared with those of previous years and the reasons for change may be

ascertained.

Helps in decision making: The management may be able

to obtain sufficient information for its work, especially for making decisions.

Weaknesses can be detected and remedial measures may be applied.

Detection of fraud: The systematic and

scientific recording of business transactions on the basis of this system

minimises the chances of fraud.

More Related Articles

👆Option Trading in India

👆Option Trading Greeks

👆How to calculate option price (Options Pricing)

👆Options Trading Strategies India

👆Options Trading Strategies Long Call

👆Options Trading Strategies Long Put

👆Options Trading Strategies Short Call

👆Options Trading Strategies Short Put

👆Options Trading Strategies Collar

👆Options Trading Strategies Bull Call Spread

👆Options Trading Strategies Bull Put Spread

👆Options Trading Strategies Bear Call Spread

👆Options Trading Strategies Bear Put Spread

Conventional

Accounting System (Traditional):

Conventional Accounting

System is based on practicability. Accounting convention means rules which by

common agreement are used in accounting. However, there is no clear information

of rules between concepts and convention.

Indian system of accounting is the example of conventional accounting. This system does not follow principles of double entry system. It is incomplete system of recording the business transactions.

Billing System Software is a popular business tool developed by DST Pvt. Ltd. which helps any kind of small, medium, or large business and helps in implementation to effectively manage all account-related operations and facilities. Generally, Billing System Software acts as an online / offline tool mainly used to create bills as well as invoices of customers, payment reports, bookkeeping and many more. It also helps in managing billing for multiple products and billing for multiple companies at the same time.

ReplyDeleteInventory and accounting software consists of lots of business applications that can easily track, manage, and organize product sales, material purchases, and other production processes. With the help of Inventory and accounting software, any business industry can minimize the time and all efforts put into tracking process. Besides, this accounting system also help to focus on analyze, find and diminish inability in their model. Contact us for Inventory and Accounting Software in Patna.

ReplyDeleteIt is very nice blog. It also provide useful information about the virtual accounting services. Contact us (310) 729-3705

ReplyDeleteTax Prep Santa Monica

Bookkeeper Santa Monica

Thanks for sharing this is a well-written and informative post on a complex topic. It provides a valuable resource for anyone interested in learning about Double Entry Bookkeeping.

ReplyDeleteaccounting services usa