|

| Image by - shutterstock.com |

Journal

Or

Journal in Accounting

Or

Journal in Bookkeeping

Introduction

Everyday businessmen perform large number of transactions. These

transactions cannot be remembered at a glance. Therefore these transactions

must be recorded in different types of books. He keeps different accounting

records. The number of books depends upon the size and nature of business and

volume of transactions but important books of accounts which must be maintained

by every business men are Journal and Ledger.

Journal is a book employed to classify or sort out transaction in a form

convenient for their subsequent entries in Ledger Journal keeps record of daily

financial transaction. It is also known as Book of Original Entry. When the

Journal transactions are recorded in the Journal it becomes Journal entry.

Journal entries consist of the name of debit and name of credit involved

in the financial transaction with a brief narration. Journal is a book in which

the business transactions are first recorded in a chronological order i.e. Date

wise in the order in which they take place. Generally the different types of

Books of Accounts are maintained by a businessman for recording the business

transactions.

He maintains primary books and secondary books, Primary books include

Journal proper and special Journal which includes Purchases Books, Sales Book,

Purchase Return Book, Sales Return Book, Bills Receivable Book, Bills Payable

Book and Secondary Book includes Journal Ledger.

Related Articles

👆 Financial Accounting

👆 Types of Accounting

👆 Cost Accounting

👆 Types of Cost Accounting

👆 Methods and Techniques of Costing

👆 Cost Sheet

👆 Cost Management

👆 Cost Control and Reduction

👆 Cost Accounting System

👆 Difference between Cost Accounting and Financial Accounting

👆 Management Accounting

👆 Materials Control

👆 Bookkeeping

👆 Accounting methods

👆 Accounting Terminologies

👆 Double Entry System

👆 Classification of Accounts

Meaning

The word “Journal” is derived from the French word “JOUR” which means a

“Day”. Therefore journal means a “daily record”. A journal contains a daily

record of business transactions and hence it has been named so, as soon as a

transaction takes place its debit and credit aspects are analyzed and first of

all recorded chronologically i.e. In the order of their occurrence(taking

place). Journal is a book of original entry or primary entry.

Definition

According to L.C.Cropper “A journal is a book, employed to

classify or sort out transactions in a form convenient for their subsequent

entry in the Ledger”

According to a Dictionary for Accountant written by Eric Kohler “

A Journal is the book of original entry are recorded transaction not provided

for in specialised journals”.

Importance and utility of Journal

Journal is an important book in Book-keeping. All business

organisations, keep the Journal. The importance and utility is as follows:-

This is the principal book of account. It includes all types of accounts

of business.

It shows all necessary information regarding transactions.

The Journal has date wise record of all the transactions with details

about accounts it helps to understand the events when its took place.

The Journal is subsidiary book in which all the day to day transactions

are recorded first in chronological order in debit and credit form and with the

amount of each transaction.

Accounting procedure is followed on the basis of accounting documents.

The narration provides a brief explanation about the transactions .It

helps to increase the clarity of every transaction.

It helps to find and prevent errors.

It helps to check arithmetical accuracy of the transactions.

It helps in preparation of Final Accounts.

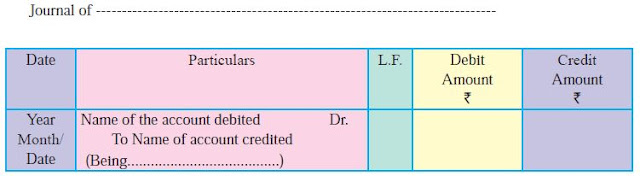

Format/ Ruling/ Performa of Journal

Explanation of Columns

Date: In this column of Journal records of the

year, month and date of every transaction is written. The year should be

written at the top and below that the month and date should be written.

Debit A/c: It records the name of the account to be debited.

Credit A/c: It records the name of the account to be

credited.

This is decided by applying the rules of Debit and Credit. The account

to be debited is always written first. The word “Dr” is written in front of

debited account just near L.F. Column. The account to be credited is written on

the next line beginning with the word “To” after leaving short space just near

date column. Narration is to be written just below the journal entry.

Narration: After each entry, a brief explanation of the

transaction together with necessary details is given in the particulars column

with in brackets called narration. The words ‘For’ or ‘Being’ are used before

starting to write down narration. Now, it is not necessary to use the word

‘For’ or ‘Being’.

Ledger Folio Number: It means page number of the ledger. The transaction

entered in the journal is posted to the Ledger. In this column the page number should

be recorded against each and every account at the time of posting in ledger.

The Folio number may be written in ‘red ink’ to distinguish them from the

amount.

Debit Amount: In this column the amount of debit account is

written.

Credit Amount: In this column the amount of credit account

is written.

Casting of Journal

At the end of each page of Journal, the total of debit amount and credit

amount column is taken to check arithmetical accuracy of the transaction. The

totals of both the columns must be equal.

After recording Journal Entries, at the end of each page the total of

amount columns is carried forward to the next page by writing the words Total

c/f in particulars column. The next page will begin with the total brought

forward from previous page, by writing the words Total b/f, on the last page of

journal ‘Grand Total’ is casting.

Journalising

The process of entering or recording the transaction in a Journal is

called as journalising.

Steps in Journalising

The process of analysing the business transactions under the heads of

debit and credit and recording them in the Journal is called

Step 1

Determine the two accounts which are involved in the transaction.

Step 2

Classify the above two accounts under Personal, Real or Nominal.

Step 3

Find out the rules of debit and credit for the above two accounts.

Step 4

Identify which account is to be debited and which account

is to be credited.

Step 5

Record the date of transaction in the date column. The year

and month is written once, till they change. The sequence of the dates and

months should be strictly maintained.

Step 6

Enter the name of the account to be debited in the particulars

column very close to the left hand side of the particulars column followed by

the abbreviation Dr. in the same line. Against this, the amount to be debited

is written in the debit amount column in the same line.

Step 7

Write the name of the account to be credited in the

second line starts with the word ‘To’ a few space away from the margin in the

particulars column. Against this, the amount to be credited is written in the

credit amount column in the same line.

Step 8

Write the narration within brackets in the next line in

the particulars column.

Step 9

Draw a line across the entire particulars column to separate

one journal entry from the other.

How transaction travels

Example 1: Purchased Laptop from Peter & Company worth 50,000 at 18% GST and amount paid by cheque

Cost of Laptop = 50,000

Add:CGST 9% = 4,500

SGST 9% = 4,500

Net value = 59,000

More Related Articles

👆Option Trading in India

👆Option Trading Greeks

👆How to calculate option price (Options Pricing)

👆Options Trading Strategies India

👆Options Trading Strategies Long Call

👆Options Trading Strategies Long Put

👆Options Trading Strategies Short Call

👆Options Trading Strategies Short Put

👆Options Trading Strategies Collar

👆Options Trading Strategies Bull Call Spread

👆Options Trading Strategies Bull Put Spread

👆Options Trading Strategies Bear Call Spread

👆Options Trading Strategies Bear Put Spread

Writing

of Journal Entries

Simple Journal Entry: In a simple entry, only two accounts are affected, one account is

debited and the other is credited. Few transactions are given below for Simple

Journal Entries.

Combined Journal Entry: In many of transactions ,more than two accounts are affected . A

Journal Entry which contains more than one debit or more than one credit or

both is called as a combined /compound Journal Entry.

Thus, in a combined Journal Entry.

Several accounts are debited and one account is credited.

One account is debited and several accounts are credited.

More than one account is debited and more than one account is credited.

No comments:

Post a Comment