|

| Image by - Pixabay.Com |

Long Combo

Long Combo Option Trading Strategy is implemented when a trader is

bullish in nature and expects the stock price to rise in the near future. Here

a trader will sell one ‘Out of the Money’ Put Option and buy one ‘Out of the

Money’ Call Option. This trade will require less capital to implement since the

amount required to buy the call will be covered by the amount received from

selling the put.

A long Combo strategy is a Bullish Trading Strategy employed when a

trader is expecting the price of a stock, he is holding to move up. It involves

selling an OTM Put and buying an OTM Call. The strategy requires less capital

as the cost of Call Option is covered by premium received from Put Option.

Long Combo strategy should be deployed when you're Bullish on an underlying

but don't have the required capital or the risk appetite to invest directly

into it.

Stock Market Related Articles

👆Option Trading in India

👆Option Trading Greeks

👆How to calculate option price (Options Pricing)

👆Options Trading Strategies India

👆Options Trading Strategies Long Call

👆Options Trading Strategies Long Put

👆Options Trading Strategies Short Call

👆Options Trading Strategies Short Put

👆Options Trading Strategies Collar

👆Options Trading Strategies Bull Call Spread

👆Options Trading Strategies Bull Put Spread

👆Options Trading Strategies Bear Call Spread

👆Options Trading Strategies Bear Put Spread

👆Options Trading Strategies Synthetic Long Call

👆Options Trading Strategies Covered Call

This is a fairly complex options strategy. It requires

that the trader knows how options move with the underlying, and more

importantly, how selling out of the money (OTM) put options and buying out of

the money (OTM) call options can have an impact on the trade.

The secret to a successful trade is to ensure that the timing of the

trades is done in tandem and that the correct strike prices are chosen. It is

important to note that the risk is unlimited since you are selling a OTM Put

option (anytime you sell a put option your risk is unlimited).

The strategy can work out very well. As the stock price of the underlying

rises the strategy starts making profits as both the OTM Call and the OTM Put

generate profits together.

Breakeven Point is Call Strike + Net Premium

Reward Unlimited

profit

Risk Unlimited

loss (Lower Strike + Net Premium)

Action

Sell ‘Out of the Money’ Put Option

Buy ‘Out of the Money’ Call Option

Example

NIFTY is trading at 11500 levels, Mr. G wants to enter in a long combo

strategy. He will sell one 11300 OTM Put Option for a premium of Rs. 80 &

buy one 11700 OTM Call Option for a premium of Rs. 100. The lot size of NIFTY

is 75.

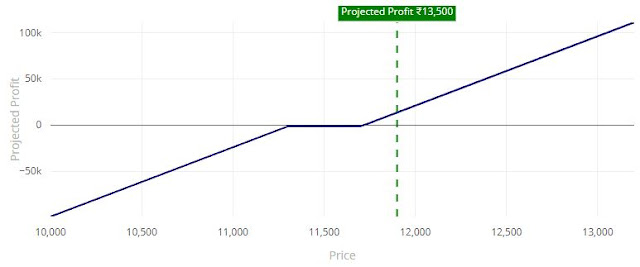

Image by - sensibull.com

Breakeven Point Breakeven Point is 11720 (11700+20).

Image by - sensibull.com

Result 1: At expiry if NIFTY closes at 11100, then Mr.

G will incur a loss of Rs. 16,500.

Image by - sensibull.com

Result 2: At expiry if NIFTY closes at 11400, then Mr.

G will make a loss of Rs. 1,500.

Image by - sensibull.com

Result 3: At expiry if

NIFTY closes at 11900, then Mr. G will make a profit of Rs. 13,500.

Thanks for sharing about this book that explains in detail about Option Trading Strategy

ReplyDeleteThe blog is very useful and attractive, sharetipsinfo provides best share market tipsand other recommendations for better earning from stock market.

ReplyDelete